aurora co sales tax rate

The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL.

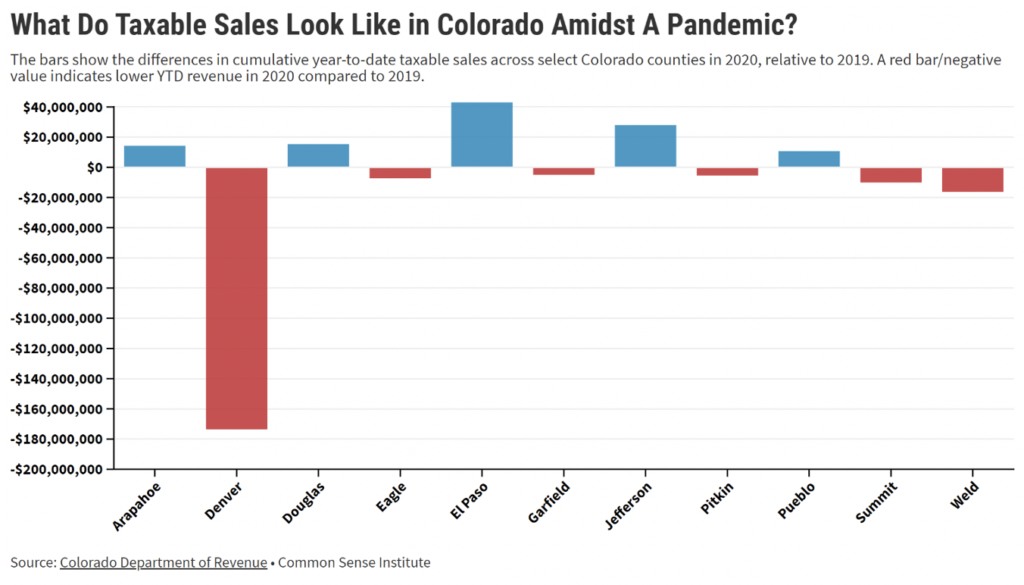

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora has parts of it located within Adams County and.

. The 2018 United States Supreme Court decision in South Dakota v. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. The Arapahoe County sales tax rate is.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Aurora has parts of it located within DuPage County. The City of Auroras tax rate is 9225 and is broken down as follows.

See reviews photos directions phone numbers and more for Sales Tax Rate locations in Aurora CO. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. City of Aurora 25.

Sales Tax and Use Tax Rate of Zip Code 80016 is located in Aurora City Douglas County Colorado State. Jackson Hewitt Tax Service. Sales Tax and Use Tax Rate of Zip Code 80018 is located in Aurora City Arapahoe County Colorado State.

The current total local sales tax rate in Aurora MO is 8850. Aurora MO Sales Tax Rate. The average cumulative sales tax rate in Aurora Colorado is 804.

This is the total of state county and city sales tax rates. The Colorado state sales tax rate is currently. 4 rows The current total local sales tax rate in Aurora CO is 8000.

Sales Tax Rate in Aurora CO. 2 State Sales tax is 290. Effective July 1 2022.

There is no applicable city tax or special tax. The December 2020 total. This includes the rates on the state county city and special levels.

The 7 sales tax rate in Aurora consists of 575 Ohio state sales tax and 125 Portage County sales tax. 5 rows The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams. The County sales tax.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. Name A - Z Sponsored Links. 6 rows Monthly if taxable sales are 96000 or more per year if the tax is more than 300 per month.

This includes the rates on the state county city and special levels. 5 State Sales tax is 290. Aurora-RTD 290 100 010 025 375.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. The GIS not only.

There is no applicable city tax or special. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax.

The Colorado sales tax rate is currently. You can find more tax. Aurora Cd Only in Colorado has a tax rate of 7 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora Cd Only totaling 41.

The average cumulative sales tax rate in Aurora Illinois is 825.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Aurora Colorado Sales Tax Rate Sales Taxes By City

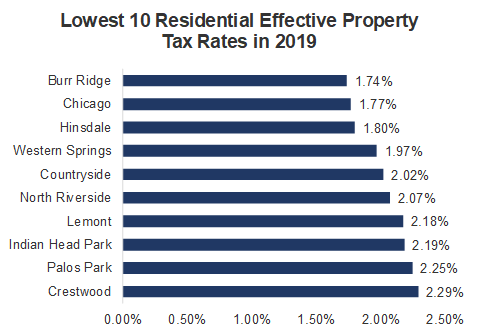

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Illinois Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

How Colorado Taxes Work Auto Dealers Dealr Tax

Kansas Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Is Food Taxable In Colorado Taxjar

Utah Sales Tax Rates By City County 2022

How Colorado Taxes Work Auto Dealers Dealr Tax