social security tax limit 2022

We call this annual limit the contribution and benefit base. This is 260 higher than the 2021 max of 8854.

Social Security Wage Base Increases To 142 800 For 2021

1510 6040 for four Full Retirement Age by Year of Birth.

. For 2022 the maximum limit on earnings for withholding of Social Security old-age survivors and disability insurance tax is 14700000. The self-employment tax rate is 153. CNBC reported that a recent congressional proposal aims to apply the payroll tax on wages of 400000 and up to help address Social Securitys solvency problem.

Filing single head of household or qualifying widow or widower with 25000 to 34000 income. For the period between January 1 and the month you attain full retirement age the income limit increases to 51960. The rate consists of two parts.

For 2022 the maximum wage base jumps to 147000 an increase of 4200 or 29 over the max of 142800 that was in place for 2021. Only the social security tax has a wage base limit. Maximum of four credits each year.

The OASDI tax rate for wages in 2022 is 62 each for employers and employees. 1 day agoIf your combined income is more than 34000 up to 85 of your Social Security benefits is subject to income tax. The 765 tax rate is the combined rate for Social Security and Medicare.

By law some. 1938 - 652 mos. If you are married and file a joint return you may have to pay taxes on up to.

The Social Security tax rate remains at 62 percent. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

Maximum Taxable Earnings Each Year. That means an employee earning 147000 or more would pay a maximum of 9114 into OASDI. Employers then match any Social Security taxes.

The tax rates. When you file your tax return the following year you can claim a refund from the IRS for Social Security taxes withheld that exceeded the maximum amount. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum.

Wage Base Limits. If your combined income was more than 34000 you will pay. Fifty percent of a taxpayers benefits may be taxable if they are.

Also as of January 2013 individuals with earned income of more than in Medicare taxes. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Most people need.

There is no limit on the amount of earnings subject to Medicare hospital insurance tax. For earnings in 2022 this base is 147000. This update provides information about Social Security taxes benefits and costs for 2022.

The wage base limit is the maximum wage thats subject to the tax for that year. For earnings in 2022 this base is 147000. As the maximum taxable salary is 147000 the maximum tax payable is therefore 9114.

If you earn above this no additional Social Security tax is owed and no income above this threshold is counted when your benefits are ultimately calculated as a. 1957 - 666 mos. The Medicare portion HI is 145 on all earnings.

This amount is also commonly referred to as the taxable maximum. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

IRS Tax Tip 2022-22 February 9 2022 A new tax season has arrived. The OASDI tax rate for wages in 2022 is 62 each for employers and employees. If a couple is married each person would have a 147000 limit.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. For every 2 you exceed that limit 1 will be withheld in benefits. The exception to this dollar limit is in the calendar year that you will reach full retirement age.

Social Security tax increase in 2023. At a rate of 62 the maximum Social Security taxes that your employer will withhold from your salary is 9114. 1942 - 6510 mos.

This figure is for each not for both at the same time. That means an employee earning 147000 or more would pay a maximum of 9114 into OASDI. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security.

In 2022 the limit is 147000. 1 2022 the maximum earnings subject to the Social Security payroll tax will increase by 4200 to 147000up from the. Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits.

This means that earnings up to 147000 would still be. If that total is more than 32000 then part of their Social Security may be taxable. There is the OASDI tax rate and it is currently set at 62 for employees and employers.

Updated April 2022 1 2022 Social SecuritySSIMedicare Information. Or Publication 51 for agricultural employers. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below.

9 rows This amount is known as the maximum taxable earnings and changes each year. Social Security and Medicare taxes. For 2022 the Social Security earnings limit is 19560.

The resulting maximum Social Security tax for 2022 is 911400. On the other hand for self-employed workers it goes up to 124. Employeeemployer each Self-employed Can be offset by income tax provisions.

Self-employed people are. What is the income limit for paying taxes on Social Security. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each.

Hospital Insurance HI also called Medicare Part ANo limit Federal Tax Rate1 Max OASDI Max HI Earnings Required for a Quarter of Coverage in 2022. Self-employed people are responsible for covering both the employer and employee share of OASDI contributions.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Pin By Onesmo Peter On Budget And Investment In 2022 Economics Lessons Money Saving Plan Financial Management

How Can I Figure Out My Payroll Taxes In 2022 Payroll Taxes Payroll Tax

Budget 2022 Provision Of Social Security For Income Tax Assessees Need Of Hour In 2022 Income Tax Social Security Income

What Small Business Owners Should Know About Social Security Taxes

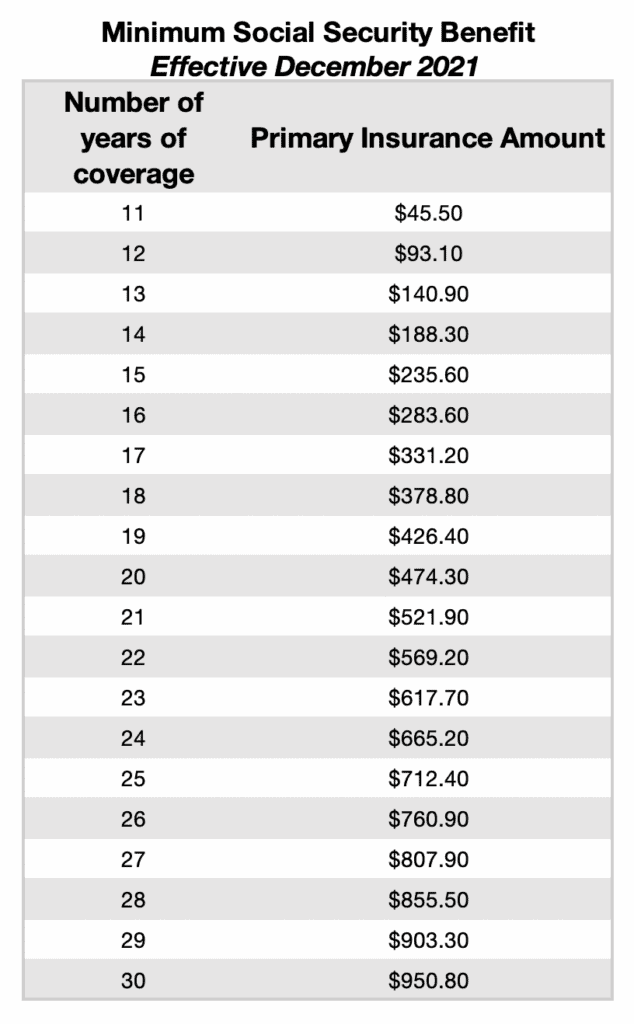

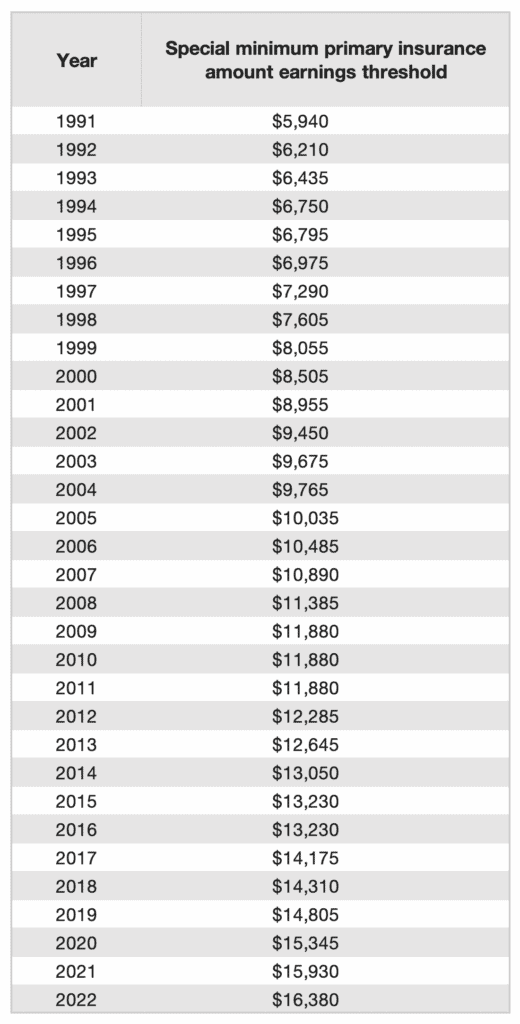

What Is The Minimum Social Security Benefit Social Security Intelligence

What Is Fica Tax Contribution Rates Examples

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

4 Social Security Changes To Expect In 2023 The Motley Fool

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Both Centre And State Government In 2022 State Government Government Social Security Benefits

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

What Is The Social Security Tax Limit

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Is The Minimum Social Security Benefit Social Security Intelligence

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

All The States That Don T Tax Social Security Gobankingrates